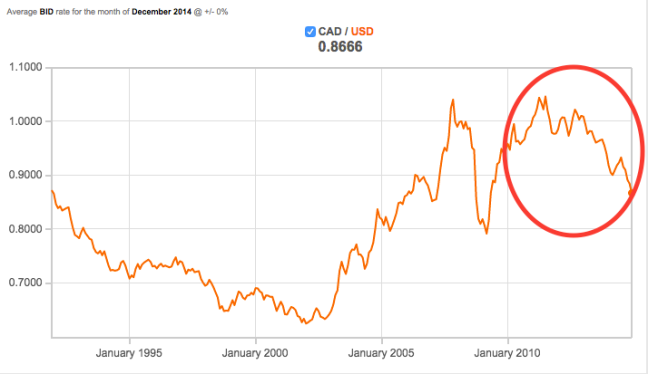

So I recently sold an apartment in Toronto and need to move that money down to the US. Big problem, CAD has been on its way down (relative to recent historical highs), as you can see in this chart:

Is it going to keep going down? I’ve got at least a year until I need the money. Should I wait?

There’s no obvious reason to wait. Spot rates incorporate all information so this is where the market expects the Canadian dollar to be. Options just load the spot rate for the difference between strike and asset interest rates and volatility. No point speculating AND adding leverage and option costs.

The common heuristic here is to average the FX hit over time to minimize local fluctuations and get a truer market view. Boring but probably best. How frustrating that I’m a year late. What the hell happened?

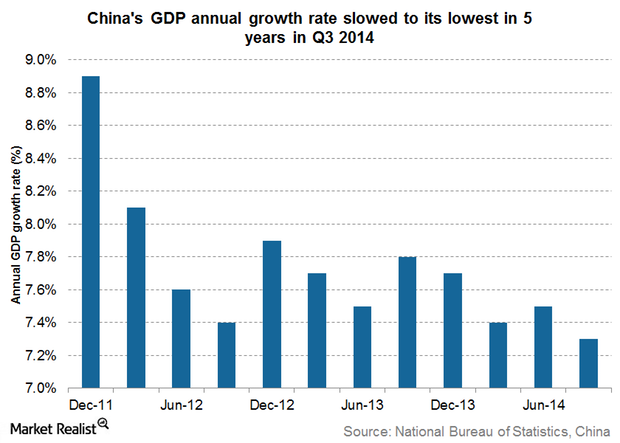

My working model is that CAD:USD is, at the margin, a resource bet. Where does the marginal raw material get consumed? China. What’s happening in China?

Oh, I see. OK. What does Michael Pettis (aka the best commentator I’ve read on this topic) say?

As investment surged, China’s physical capital converged with its social capital (i.e. its infrastructure more or less converged to its ability to exploit this infrastructure productively), after which additional physical capital was no longer capable, or much less so, of creating real wealth.

Instead, continued rapid increases in investment directed by the controlling elites (especially at the local and municipal levels) created the illusion of rapid growth. Because this growth was backed by even faster growth in debt, however, it was ultimately unsustainable. This period began around the beginning of the last decade, I would argue, and it is the period in which we currently find ourselves.

Ok, Pettis so what’s going to happen next?

First, substantial direct or indirect wealth transfers from the state sector to Chinese households will unleash a surge in household consumption as household income rises (and because the interest on bank deposits is an important source of income for most middle and lower middle class households, if the authorities reduce interest rates, as struggling borrowers are demanding, China actually moves in the wrong direction). The constraint here of course is political, because the elites who benefit from the state control of these assets are likely to be highly resistant to any such transfer.

Second, substantial reform in corporate governance within the banking system should be aimed at causing a substantial shift, as rapidly as possible, in the credit allocation process, so that state-related entities that systematically malinvest, like local governments and state-owned enterprises, receive a smaller share of credit while small and medium enterprises, who tend in China to be far more efficient users of capital, receive a much greater share. Of course there will also be a significant political constraint here too, and for the same reasons.

It will be hard to do either very quickly. The sets of policies that lead to either outcome are politically difficult to implement because they force a disproportionate share of the adjustment costs onto the very powerful sectors that received a disproportionately large share of China’s growth in the past two decades. What’s more, the consumption impact of wealth transfers to the household sector will lag, depending on how credible they are, while reforming the financial sector is always a slow and disruptive process.

Boy, that soft landing presupposes insiders lose some nasty political fights. Let’s say this transition happens instantly (market prices adjust instantly) and China looks more like, say, Mexico or Brazil tomorrow. That reorientation to consumption means less resources because an infrastructure / investment economy probably uses more stuff than a economy. That’s bad for CAD:USD. No wonder it’s in the toilet.

On the other hand let’s say Pettis’ view is the mainstream. And let’s say his cautious optimism of Chinese leadership is dead wrong. Worst case (from a present value of global GDP perspective), China can’t implement reforms and they keep investing and resource consumption surprises people on the upside for a while. That means long term pain I think, but some short term gain for me. I’d say this could drive a spike in CAD:USD soon. That would be nice. For me. Short term.

But I’m (sorta literally) betting the farm here kids. Let’s go through some scenarios.

- Worst case for CAD:USD is Chinese collapse within a year, which probably requires things to be worse than they look right now. I’d say this is unlikely.

- Next worst case is a deterioration of CAD:USD in the next year but not a collapse. Maybe political change gains ground (as filtered through the national media, an untrustworthy narrator). You might think of the current price as a weighted average of this outcome and a surprise upside outcome. What does the post-soft-landing China look like? 90s-era global prices?

Yikes, sub-$40 oil and 0.6-0.75 CAD:USD? I don’t want that. I think that the marginal barrel of oil is more expensive (and more Canadian, though also more American) than it once was, so we’re probably looking at something a fair bit higher than that in this scenario.

Yikes, sub-$40 oil and 0.6-0.75 CAD:USD? I don’t want that. I think that the marginal barrel of oil is more expensive (and more Canadian, though also more American) than it once was, so we’re probably looking at something a fair bit higher than that in this scenario. - Mean case is today’s forecast of the rate (ie today’s rate) comes true. Sucks relative to two years ago but no cost or benefit to waiting, really.

- Next is an upside surprise. This could happen if, as I suggest above, the Chinese political process picks short term benefit and investment keeps humming along. They surprise markets and strengthen the Anti-Pettis Chinese Bulls’ case. A spike in the exchange rate.

Within a one-year horizon, I’m going to discount #1 to 0% probability. That means, again within a one-year time horizon, do I want to take a bet of moderate downside (#2) vs possibly substantial upside (#4)?

For some of the nest egg, I probably do. I’ll move some and wait with the rest. The conventional heuristic after all.

One thought on “So I’ve Got These Canadian Dollars… (speculation on CAD:USD)”